is colorado a community property state death

The rules vary greatly on this. However the Uniform Disposition of Community Property Rights at Death Act UDCPRDA was adopted by Colorado legislators in 1973.

Community Property States List Vs Common Law Taxes Definition

If the property owner died while living out of state the type of probate proceeding necessary to transfer the Colorado real estate depends on.

. California Nevada and Washington also include domestic partnerships under community property law. If Texas real estate is community property it becomes subject to the Texas rules regarding division or distribution of community property. What happens to community property at death.

Community Property After Death. When someone dies owning Colorado real estate a probate administration is necessary to transfer the property either to a buyer or to the estate beneficiaries. Joint tenancy or tenancy in common.

Instead of dividing property 5050 in a divorce case the Colorado courts will divide marital property. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property. A summary of each of the community property states treatment of property purportedly titled in joint tenancy or tenancy in common is shown in Exhibit 25181-1.

Community property states grant each spouse the right to half of the community property when the marriage ends either in death or in divorce. IRC 1014b6 provides for a basis adjustment for 100 of community property. Community property is subject to certain liabilities and obligations after the death of a spouse.

The courts ability to divide marital property if a couple divorces does not impact a spouses ability to give away his share of. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own. In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

That means that the assets and debts acquired during marriage ie. That is for both spouses shares on the first death. Generally all community debts of the deceased spouse are required to be cleared from the community property.

But should there be no one left to claim it it will escheat into the states hands. These rules apply in two contexts. A community property state is one in which the assets of a married couple are considered to be owned jointly even if only one spouse holds a title to a particular asset or piece of property.

Is Colorado considered a community property state. For this reason the state does not allow one spouse to disinherit the other and a surviving spouse is entitled to a minimum amount of property from the probate estate. The division of property is one of the main issues during a divorce case in Colorado.

Some state statutes require the property to bear the funeral expenses medical expenses and the cost of administration expenses. Joint Tenancy Tenants in Common. Colorado is not a community property state but it does have a category called marital property.

The year that Colorado adopted an act is designated in parentheses. Colorado is an equitable distribution divorce state. Treatment of Community Property on Divorce.

Colorado doesnt recognize community property as its a separate property state. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own. The Colorado UCDPRDA law provides that when one married person dies half of the marital property goes to the surviving spouse.

In a divorce proceeding the court will order a just and right division of the couples community. The marital estate should be divided equitably between the spouses upon dissolution of marriage legal separation or annulment. Colorado is not a community property state in a divorce.

Colorado doesnt recognize community property as its a separate property state. Types of Co-ownership in Colorado. Each spouse is entitled to leave his half of the community property to survivors via either will or inheritance and the law in many states allows spouses during their.

As a result assets within a marriage will be divided equitably among the spouses under Colorado law. Although Colorado is not a community property state it may be important for couples moving to Colorado to retain. Other community property states recognize these forms of ownership and will treat the asset as separate property of the spouses held in joint tenancy.

While death is as certain as taxes it doesnt wipe out debts especially if you live in a community property state such as Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin community property law also applies in Alaska in certain circumstances. The Colorado UCDPRDA law provides that when one married person dies half of the marital property goes to the surviving spouse. It uses a common law doctrine rather than one based on the laws of community property.

Posted in Divorce on October 21 2020. When considering the division of property during a. Colorado is a marital property state not community property.

Which states do not have community property. Colorado inheritance laws are designed to dig up a relative who could inherit your property. Colorado is not a community property state in a divorce.

It is important to understand the difference between the two types of co-ownership especially as it relates to how. Colorado inheritance laws are designed to dig up a relative who could inherit your property. Is Colorado A Community Property State Death - A number of western states including colorado 3 montana 4 utah 5 and wyoming 6 have adopted the uniform disposition of community property rights at death act.

November 14 2017. Colorado is not a community property state but it does have a category called marital property In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce. In Colorado as in most states marriage is considered a partnership.

Colorado is also a dual-property state which means property can be defined as either marital or. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property. When two or more people take title together to real estate in Colorado they will have to decide what form of co-ownership to take.

Act Regulating Traffic on Highways 1931 Act to Secure the Attendance of Witnesses From Without a State in Criminal Proceedings 1939 Adult Guardianship and Protective Proceedings Jurisdiction Act 2008 Alcoholism and Intoxication Treatment Act 1973 Anatomical Gift Act 1969 and 2007. A non-probate asset is property of an estate that is not required to pass through the probate process or any similar to it.

Colorado Inheritance Laws What You Should Know Smartasset

Community Property States List Vs Common Law Taxes Definition

States With No Estate Tax Or Inheritance Tax Plan Where You Die

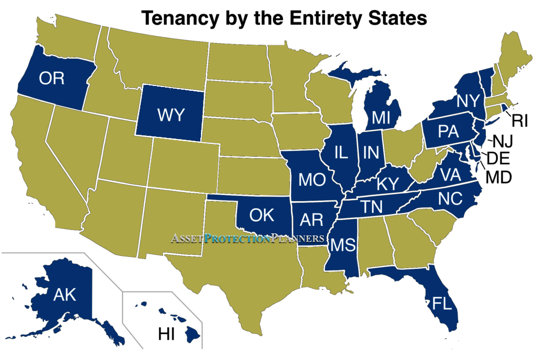

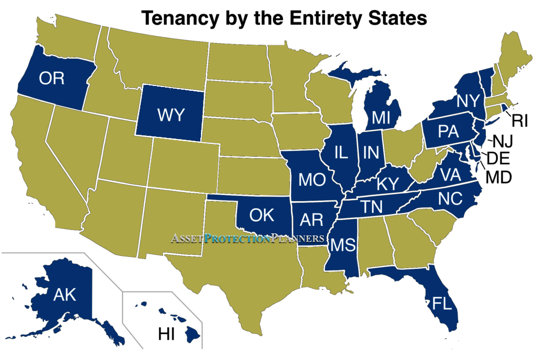

Tenancy By The Entirety States Vs Joint Tenants Community Property

Colorado Inheritance Laws What You Should Know Smartasset

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com