1031 tax deferred exchange meaning

A 1031 Exchange is the swap of qualified like-kind real estate for other qualified like-kind real estate structured pursuant to 1031 of the Internal Revenue Code. That means that property must be exchanged for other property rather than sold for cash.

1031 Exchange Explained What Is A 1031 Exchange

Gain deferred in a like-kind exchange under IRC.

. With the TDCO strategy as long as the 1031 Exchange. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and. Thanks to the 1031 exchange you can reinvest the profits into.

You avoid having to claim a loss or gain on your taxes. A 1031 exchange allows you to defer capital gains tax thus. In these cases they should consider whether they want to take advantage of a 1031 tax-deferred exchange.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the. Section 1031 of the Internal Revenue Code provides that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for. A 1031 exchange allows you to defer gains taxes on a property that you sell.

November 20th 2020. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business. The exchange distinguishes an IRC 1031 tax deferred transaction from a taxable sale and.

1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property. This means that when the reinvestment property is sold the deferred capital gain from the disposed property plus any.

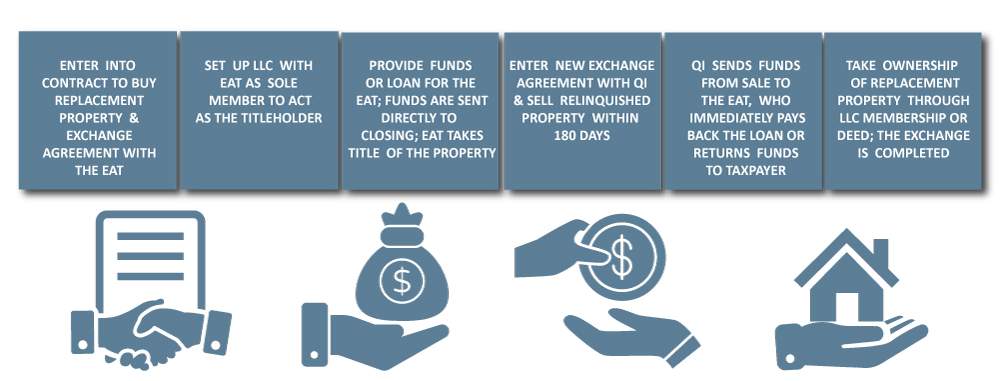

Accommodator will cooperate and release the funds to the TDCO. As with all of the tax deferral strategies there are certain rules to follow so that the strategy remains valid and. Strategy then the failing exchange can be rescued BEFORE it.

A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. A 1031 exchange gets its name from IRC Section 1031 which allows you to avoid paying taxes on any gains when you sell an investment property and reinvest the proceeds into. The tax advantage with a 1031 exchange is a deferral.

A 1031 tax-deferred exchange is a special deal where you and someone else trade properties of similar value. Jobs Act of December 2017 prohibited personal property like franchise licenses. Our expert advisors can help.

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. Under Section 1031 of the United States Internal Revenue Code 26 USC. The main benefit of carrying out a 1031 exchange rather than simply selling one property and buying another is the tax deferral.

Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss shall be recognized on the exchange. A 1031 tax-deferred exchange provides a great way for investors to defer capital gains taxes by selling one investment property and using those same. Enter the 1031 Tax Deferred Exchange.

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

1031 Exchange Guide Jtc Americas

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

How To Do 1031 Exchange For Real Estate Property Guide

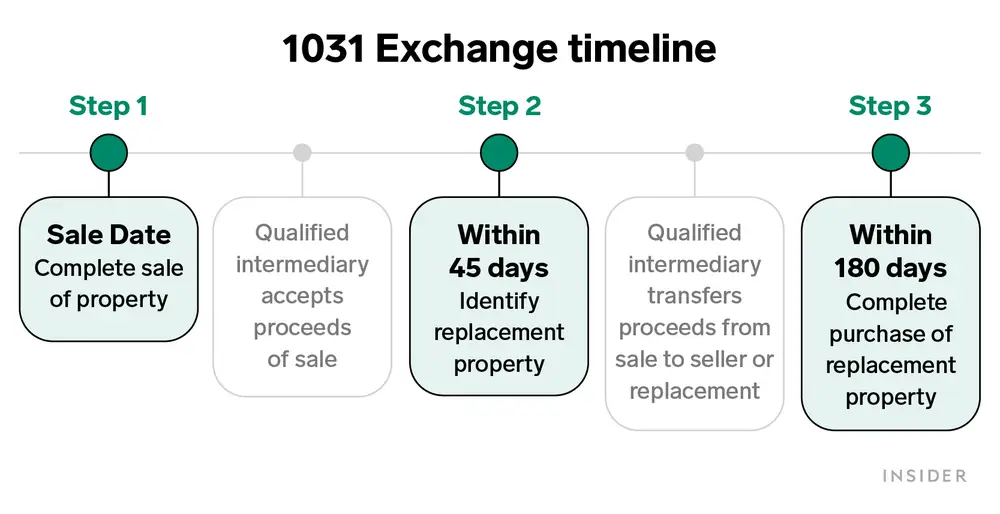

1031 Exchange Timeline How The Irs 1031 Exchange Process Works

1031 Exchange What Is It And How Does It Work Plum Lending

1031 Exchanges Explained The Ultimate Guide Cws Capital

Irc 1031 Exchange Https Www Serightesc Com

The State Of 1031 Exchange In 2022 Old Republic Title

Top Misconceptions About 1031 Exchanges Ipx1031 New For 2022

What Qualifies For A 1031 Exchange Edmund Wheeler

1031 Exchange Financing Bridge Loans Wilshire Quinn Capital

Delayed 1031 Exchange Exchange Timelines Deadlines Ipx1031

1031 Exchanges Explained The Ultimate Guide Cws Capital

1031 Exchange Archives Mckenney Investment Properties

1031 Exchange Guide For 2021 1031 Exchange Rules

What Is A 1031 Exchange Tax Deferred Sales In Colorado Colorado Country Broker